Staff / Billing / Tax rules¶

In this section you can define tax rules. Tax rules will be used to apply taxes when generating invoices for taxable services.

For a detailed explanation on how VAT is applied for European Union clients, see VAT ID validation flow.

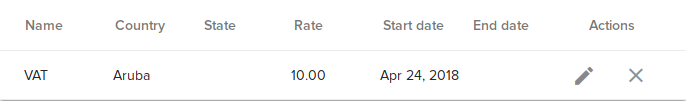

When you access this section you will see a table containing all tax rules defined

The columns have the following meaning:

Name - The name of the tax

Country - The country where this tax applies; the tax is only applied to clients from this country

State - The state where this tax applies; the tax is only applied to clients from this state

Rate - The tax rate in percents

Start date - The first date when tax applies; tax will be applied to invoices starting with this date

End date - The last date when tax applies; tax will be applied to invoices up until this date

For each tax rule delete and edit actions are available.

Create tax rule¶

Clicking the create button will allow you to create a new tax rule.

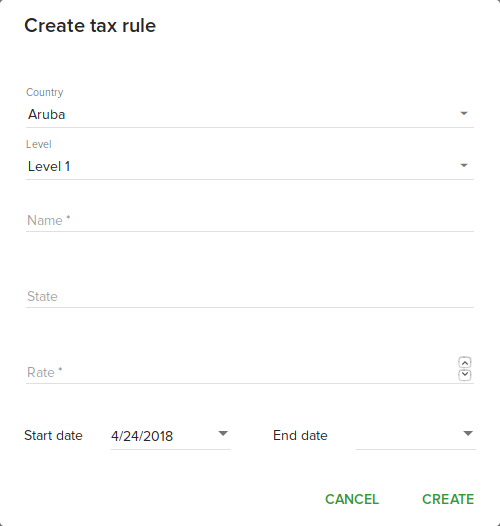

After clicking a create dialog will be displayed.

Level - The level field allows you to select tax level. When applying taxes first all Level 1 taxes will be applied then all Level 2 taxes will be applied to the amount resulted after applying Level 1 taxes.

Complete all needed fields then click Create in order to create a new tax rule.

Delete tax rule¶

Click delete button near the tax rule to delete the rule. A confirmation dialog will be displayed.

Click Yes to delete the rule.

Edit tax rule¶

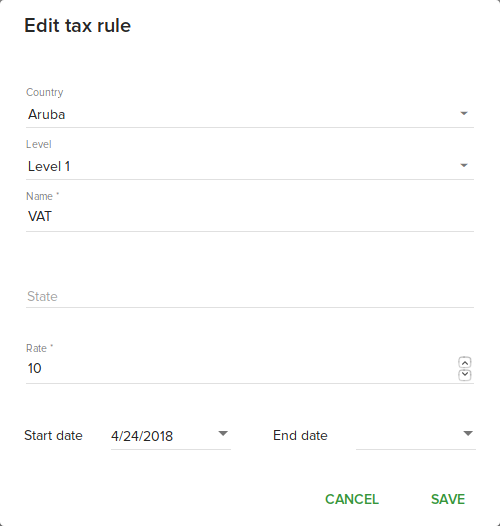

Clicking the edit button will allow you to edit a tax rule.

Complete all fields you want to change then click Save in order to save changes to the tax rule.